The Power Of Thought

The power of thought in business is a transformative concept that emphasizes how mindset, mental strategies, and positive thinking can influence business success. From leadership to innovation, the way entrepreneurs, managers, and employees think can significantly affect the growth and sustainability of a business.

1.Vision and Goal Setting

The thoughts behind a business vision shape its future. Successful entrepreneurs and business leaders often start with a clear mental picture of where they want their company to go. These thoughts turn into concrete goals, plans, and strategies. Positive and focused thinking helps in creating ambitious yet achievable goals, which propel the company forward.

2.Problem Solving and Innovation

Thought is the foundation of creativity. Businesses often face challenges, and how leaders approach these challenges is critical. Positive and open-minded thinking can lead to innovative solutions. By thinking outside the box and not being restricted by conventional methods, businesses can find new ways to solve problems and gain a competitive edge.

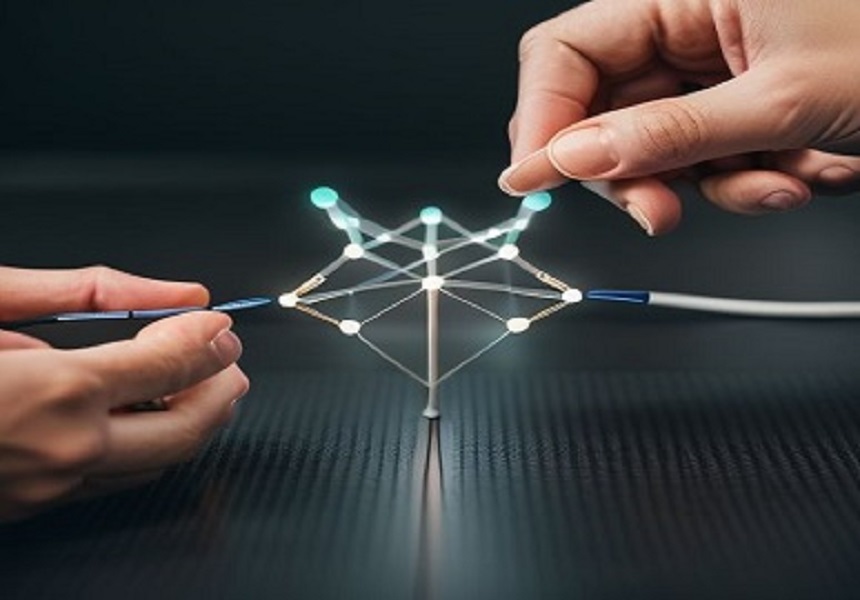

3.Networking and Opportunities

Positive thinking also affects how a business interacts with the outside world. An open, growth-oriented mindset encourages networking and the pursuit of new opportunities. Thinking big and staying open to partnerships, collaborations, and new ideas can lead to significant business expansion.

4.Mindset for Growth

A business that fosters a growth mindset—believing that skills and abilities can be developed through hard work, dedication, and learning—will thrive. This mindset encourages continuous learning, adaptability, and self-improvement, essential qualities for staying competitive in any industry.

Conclusion

The power of thought in business is undeniable. A positive, focused, and growth-oriented mindset can drive success in innovation, leadership, decision-making, and resilience. By nurturing the right thought patterns, business leaders and entrepreneurs can overcome challenges, inspire teams, and create lasting value. The way we think shapes not only our business practices but also our potential for long-term success.

LVB - India

LVB - India